By Rupinder Singh

Global trade is undergoing a seismic recalibration. The United States’ recent uptick in tariffs on a range of imported goods has injected new costs and uncertainty into long-standing supply chains — but it also creates strategic openings for exporters who can pivot fast, diversify markets, and plug into modern logistics infrastructure. For India, a large and diverse exporter, the short-term pain for some sectors can become a catalyst for accelerated structural change. And nowhere is that structural opportunity clearer than in Dholera Smart City — a purpose-built, export-ready industrial node designed for the 21st-century economy.

1. What changed – quick reality check (numbers you should know)

In August 2025 the U.S. announced stepped-up tariffs that affect a number of Indian export categories, with headline rates in some cases rising to 25–50% for affected items (notably gems & jewellery, certain textiles, and selected auto parts), while strategic sectors such as pharmaceuticals, some electronics, and energy goods were carved out or exempted in the immediate tranche. The tariff moves are part of a broader U.S. trade stance that aims to re-shore manufacturing and to use tariffs as leverage in geopolitical disputes.

India’s export profile is important context: the U.S. has been India’s largest merchandise export destination (around ~18% of merchandise exports in FY 2023–24), followed by the UAE, the Netherlands, and China — meaning any meaningful U.S. tariff action touches a big slice of India’s shipments. India’s merchandise exports in early 2025 remained large (Merchandise exports in May 2025 were about US$38.7 billion, and April–May 2025 merchandise exports totaled ~ US$77.2 billion).

Bottom line: U.S. tariffs are real, significant for certain sectors, and large enough to force exporters and policymakers to respond quickly.

2. Immediate impact on Indian exporters – sectoral snapshot

Gems & Jewellery, Textiles & Apparel: Highly exposed to U.S. duties; a short-term drop in competitiveness is likely if tariffs remain. The U.S. market accounts for a material share of these exports, so demand may shift to other origins or price points that avoid the tariff hit.

Auto components: Mixed impact – passenger vehicle parts face lower increases than some heavy/commercial vehicle parts, but complexity is rising across the supply chain.

Pharmaceuticals & Select Electronics: Many of these items were exempted in the immediate list; India’s generics and some electronics value chains remain competitive for non-U.S. markets and partially insulated from the tariff shock.

Overall macro: Tariffs raise the cost of goods for U.S. buyers, may reduce volumes to the U.S., and create short-to-medium term price pressure on exporters who cannot absorb margins or shift production quickly. J.P. Morgan and others flag risks to growth and inflation from tariff shocks — i.e., stagflation risks if tariffs persist.

3. Where India can divert – practical alternative markets (and why they matter)

India already sells to a diverse set of partners. Strategic diversification means quickly scaling shipments to markets where demand is growing or where tariff exposure is lower:

(i) European Union (Netherlands, Germany, Italy) – large, high-value markets for pharmaceuticals, textiles (premium & technical fabrics), machinery, automotive components; regulatory standards are strict, but once met, access is sticky. The Netherlands and Germany are already the top Indian destinations.

(ii) Gulf & MENA (UAE, Saudi Arabia) — proximate, growing consumer markets and re-export hubs; ideal for gems & jewellery, metals, packaged foods, and increasingly for manufactured goods. UAE is India’s #2 export destination by value.

(iii) ASEAN (Vietnam, Thailand, Indonesia, Philippines) – growing intra-Asian demand, manufacturing linkages, and regional supply chain clustering. ASEAN offers market access and manufacturing partnerships (Act East strategy).

(iv) Africa & South America – high growth pockets for consumer goods, engineering goods, and vehicles; lower tariff barriers in some bilateral dialogues and growing infrastructure demand. Latin America (select countries) is being actively pursued by Indian exporters.

The playbook is clear: diversify buyers, re-route supply chains, upgrade product compliance for EU and other regulated markets, and use regional FTAs / preferential pathways (where available) to reduce friction.

4. Why Dholera is central to India’s tactical export response

Dholera is not an accident of timing – it is a deliberate, future-focused response to exactly the kind of trade shocks we’re seeing. Several infrastructure facts matter:

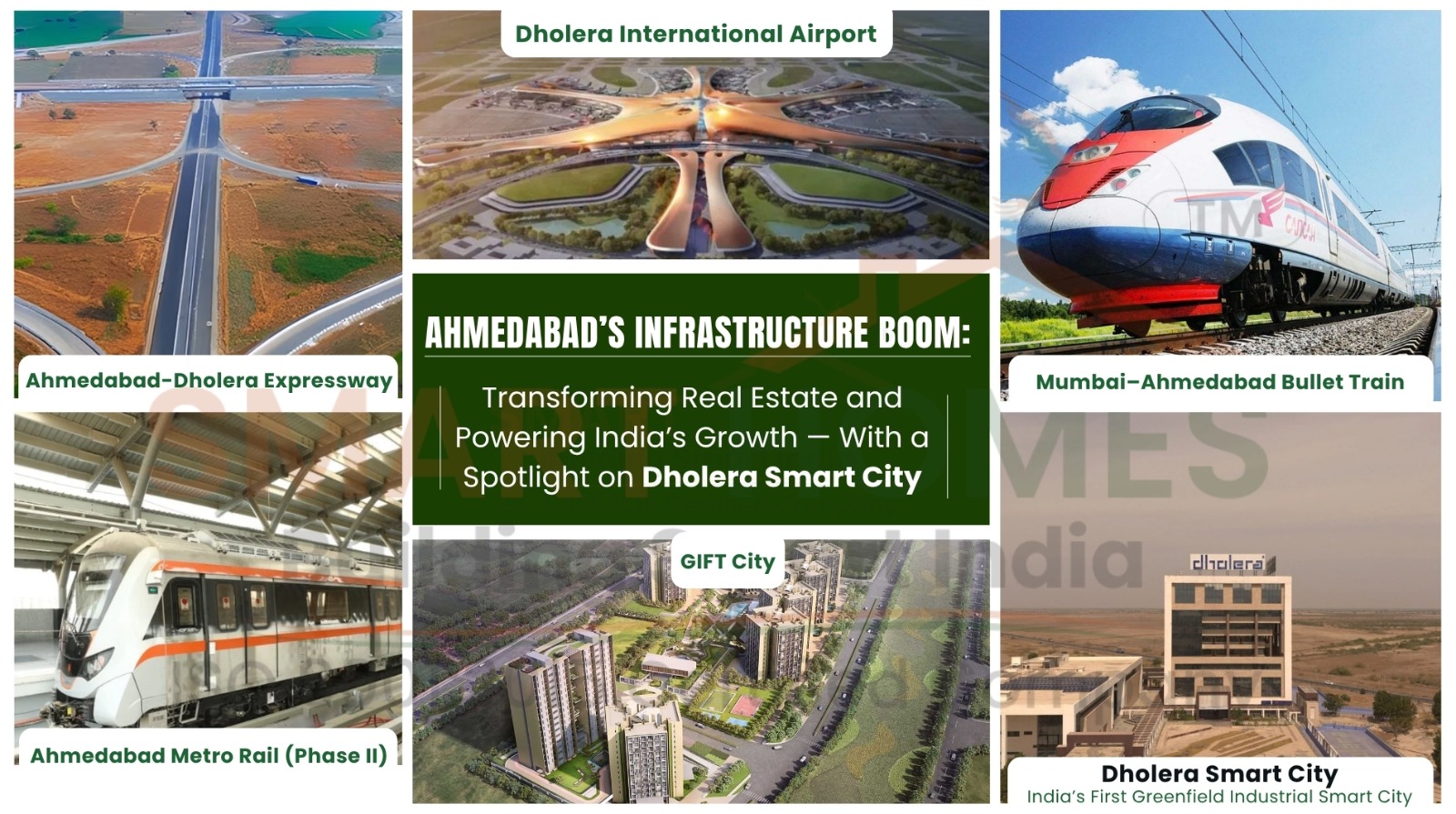

Export-linked connectivity: Dholera International Airport (soon to be operational and designated as a customs port), plus the Ahmedabad–Dholera Expressway and improving rail linkages, create a multi-modal logistics spine that reduces transit time and cost for time-sensitive exports.

Industrial cluster strategy: The city is planned to host semiconductor fabs, renewable energy manufacturing, logistics parks, and export-oriented factories — industries that benefit from captive power, dedicated common effluent treatment, and plug-and-play land parcels. Early investments from big names (semiconductor & renewables) signal anchor demand.

Customs and cargo-ready facilities: Airport customs port status and freight rails reduce paperwork time, making Dholera attractive for exporters who need fast onboarding to new markets. Recent approvals for rail lines and dedicated freight approvals strengthen this case.

In short, Dholera lowers the “time-to-market” and the logistical frictions that matter most when buyers suddenly change sourcing or when exporters have to open new routes fast.

5. Tactical recommendations – what exporters and policymakers should do now

For exporters and cluster developers (and why Dholera should be in the front row):

(i) Short term (0-6 months):

Re-route at-risk shipments to EU, UAE, and ASEAN buyers where possible. Use bonded warehousing in customs-friendly airports to re-export if needed.

Prioritize product categories with exemptions (pharma, certain electronics) to maintain dollar flows.

(ii) Medium term (6-24 months):

Build compliance fast-tracks for EU standards (CE, REACH), and create value-add facilities near ports/airports to repackage and label for alternative markets. Dholera’s design (plug-and-play lots + power + green energy options) is ideal for such value addition.

Negotiate trade facilitation arrangements with logistics providers – air cargo charters to new markets from Dholera airport can be a game-changer.

(iii) Long term (2-5 years):

Use Dholera as a hub to vertically integrate: manufacturing → final assembly → exports to diversified markets. Anchor large manufacturing (semiconductors, renewables, EV components) to reduce vulnerability to single-market shocks.

6. Strategic rationale: Why India needs more greenfield industrial smart cities

- Planned multi-modal logistics (road + rail + air + port access) dramatically lower lead times.

- Integrated utilities & digital governance speed up clearances and create predictable ease-of-doing-business — critical when exporters must re-route quickly.

- Clustered suppliers and co-located services (testing labs, compliance houses, packaging units) reduce switching costs to alternative markets.

Strategic takeaway: Building modern greenfield industrial ecosystems is not just urban policy — it’s trade strategy. Dholera is a prototype of how India can future-proof its export competitiveness.

Short case study: How a textile exporter could pivot using Dholera Smart City

A mid-sized textile manufacturer hit by U.S. tariffs can:

-

- Shift higher-end orders to the EU by using Dholera for EU-compliant finishing and packaging (faster compliance, lower logistics cost).

- Use Dholera airport customs and bonded warehousing to re-export seasonal goods to the UAE and Africa with low transit time.

- Co-locate dyeing/finishing near the park to lower lead times to new buyers — enabling quicker market trials in Latin America or ASEAN.

This tactical play becomes realistic only where infrastructure, governance, and service ecosystems are present — the exact promises Dholera was built to deliver.

“In my world of diversified businesses over the past three decades, and having watched Dholera evolve over the past decade, I can say this – trade shocks are a test of how quickly industry and infrastructure can adapt. Dholera isn’t just land and roads; it’s a logistics answer to a geopolitical problem – a place where exporters can retool, re-route, and re-enter global markets faster.” – Rupinder Singh, Founder – SmartHomes Infrastructure Pvt. Ltd.

Final assessment – risk vs opportunity

Risk: Certain sectors tied tightly to the U.S. consumer market (gems, portions of textiles, some auto parts) face near-term headwinds if tariffs persist. Exporters will see price pressure and possible order re-routing.

Opportunity: The shock accelerates diversification — opening EU, UAE, ASEAN, Africa and Latin American markets; it also makes the business case for modern, export-oriented industrial nodes. For Dholera, this is a structural tailwind: the city’s connectivity, customs readiness, and cluster logic make it a natural hub for India’s next phase of export growth.

Disclaimer: This content is based on my personal research from publicly available news portals and credible digital sources. Please conduct your own research before forming any opinion. I do not take responsibility for the accuracy of any facts or figures mentioned.